2019 Trends & Headlines We Didn't See Coming

Data is our friend, typically. It helps us make better, more informed decisions and can signal an upcoming shift in behavior. Data can also be our enemy, or at least the enemy of the beer consumer. With the growth of craft leveling off, large retailers are beginning to shrink the amount of space devoted to beer. With more breweries competing for less space, retailers want the strongest performing brands occupying the remaining real estate. The data in most cases will point them to a short list of styles that sell. These days, that's why you'll see shelf sets dominated by Session IPAs, Pale Ales, and IPAs, then to a lesser extent Lagers, Golden Ales, Wheat Beers, Kettle Sours, and Porters. It's not that breweries aren't making other styles and don't have them on draft at their Taproom. Breweries of size, who rely on chain stores to drive their business, have little choice but to focus in on those hottest sellers in order to maintain their position. Over time, this results in less style choice among the sea of SKUs, with portfolios beginning to feel all too similar. Breweries are showing a newfound nimbleness, now better prepared to pounce on the next big thing.

Small breweries are able to fill that style gap because they rely more on independent shops or direct-to-consumer sales, which affords more flexibility. But they're feeling the pinch too as they begin sharing their customer base with the shiny new taproom down the street. Small, local-focused breweries are pressured to reengage their customers with new, innovative experiences as well. Some of those will bubble up to the big leagues and eventually be adopted by large breweries. But just as often, small breweries are keeping their eyes peeled on what the largest producers are doing. Personally, I enjoy keeping tabs on both.

In January, I gathered some voices who I respect and we made predictions for what would happen in the upcoming year, knowing full well that there would be surprises. A number of emerging trends had already made their presence felt in 2018 and were expected to continue flourishing this year. For me, that would include the threats from "Big Hard Seltzer" and CBD/Cannabis infused drinks, which were well-documented last year. Another would be the need for national and regional breweries to have a Hazy IPA, whose viability was proven by Sierra Nevada & Boston Beer, then further validated by the announcement of Mind Haze by Firestone Walker in late 2018. Whether it's what was thought to be a fad reaching unexpected heights in popularity, a trend that came completely out of nowhere, or a big surprise headline, I gathered some industry friends to help fill out my list, along with some insights, of what has taken us by surprise thus far in 2019, from the big to the small, and everything in between.

1) Dry January Turns up the Heat

As someone who monitors a decent size brewery's social media and also keeps tabs on a lot of beer forums, this past January had a different feel to it. Comments from enthusiasts alluding to not drinking until February 1st were everywhere. January has always been a brutal month for beer sales, thanks to leftovers from the holidays, bad weather, and New Years resolutions. Now the entire month is being sacrificed, thanks to a movement started by a UK-based non-profit in 2013, that grew from just over 4,000 pledges in its inaugural year, to tens of millions of health and wellness minded individuals in 2019, really beginning to gain steam in the United States over the past couple years.

According to YouGov.com, a data-driven research firm, 21% of Americans planned to participate in Dry January in 2019 and another 21% think its a good idea, but didn't plan to participate. For me personally, it's gone from a concept like Whole 30 where I've known 1 or 2 friends to participate, to what's feeling like the majority of my friends outside the beer industry. And I applaud them for it honestly. Personally though, I prefer to continue showing restraint and discipline on a year-round basis, but it's hard, and Dry January now has support mechanisms to mentally get you through the obtainable 31 day period.

2) The Return of the Beer Wars

Bud has never been shy about flexing its muscles and throwing cheap shots at anyone threatening its sales growth. Feuding with Miller is nothing new either, but it seemed that the bad boys with big checkbooks had long since moved on to emerging beverage trends. In 2015, at the peak of craft’s growth, Bud fired the pumpkin peach ale shot heard round the world at the expense of their own recently acquired subsidiary Elysian, which had a beer with that description. It reminded me of this scene from Braveheart:

Longshanks: Archers

English Commander: I beg pardon, sire. Won’t we hit our own troops?

Longshanks: Yes…but we’ll hit theirs as well. We have reserves. Attack.

With craft’s growth projected as being close to flat for the foreseeable future, Bud turned their attention back to their longtime adversary for this years stunt during February's big game. Bud successfully dilly dillied their way back into the headlines, at Miller & Coors’ expense. What evolved into Corngate called the use of corn syrup by MillerCoors into question, taking full advantage of confusing terminology that the average consumer doesn’t understand and would assume meant the highly controversial sweetner known as high fructose corn syrup.

It was a fascinating strategy because of the disruption it must have caused their biggest competitor. Normally Bud leaks out their commercials in advance of the Superbowl to get their distributors and retail partners excited, but this attack was kept uncharacteristically quiet. Miller was forced to scramble and respond without warning, diverting an unplanned amount of resources toward retaliation and education efforts. It wasn't just Miller and Coors who stood to take a reputation hit, but their hundreds of distributors around the country, who are highly invested in their success and would seek an appropriate response. Miller hustled to get their own commercial out within about 6 weeks of the Superbowl, while filing a lawsuit shortly after which claimed that "AB singled out MillerCoors use of a common brewing fermentation aid, corn syrup for a deliberate and nefarious purpose: it was aware that many consumers prefer not to ingest ‘high-fructose corn syrup’ or ‘HFCS,’ and had reportedly conducted extensive focus group testing in which it found that consumers do not understand the difference between ordinary corn syrup and HFCS, the controversial sweetener commonly used in soft drinks,”

3) Small breweries launch 8oz "stubby" cans

When we moved our barrel-aged 22oz bottles to cans at Revolution Brewing in 2017, we discussed the idea of 8oz stubby cans in the early stages, and many got pretty excited about the thought. For me, and most others at the brewery, that was the ideal pour size for a >13% beer. Though not the sexiest looking vessel and restrictive for label art, I was confident that they could be done and look both exciting and premium. But before this had any legs, I went searching for confirmation and polled Facebook groups filled with beer traders and enthusiasts ISO their ideal serving size for a barrel-aged beer. Twelve ounces, to my surprise, absolutely dominated every poll.

Early in 2019, three Chicago breweries made 8oz stubby cans a reality, coincidentally within days of each other, but each going at it from completely different strategic angles.

In my home of Chicagoland alone:

Hopewell Brewing announced Lil' Buddy, a lager aimed at the on-premise (bars) targeting those looking for a final-final or perhaps a shot & beer special. At $6 to $7 for a 4-pack in the off-premise, it's not exactly a deal when looking at dollars/ounce, but the total price is low enough where consumers don't bother with math and treat it as an add-on to their intended purchase. I enjoyed quite a few on paternity leave, where 8oz was about all I could muster on little sleep.

Saint Errant, one of Chicago's smallest operations, began using the same vessel for their high ABV, sweet stouts. This strategy is more along the lines of how I would have expected this format to be used, but I never saw it coming from an upstart brewery. Similar to Hopewell's, the Saint Errant stubbies also come in 4-packs. Thus far, we have seen four unique brands from them in the 8oz cans, all high gravity.

Penrose Brewing was the third brewery I saw doing this in a short time period. They went in the direction of Northeast-style IPAs and heavily fruited kettle sours, and put them in mix four-packs

4) Market-Only Releases

Breweries are catching a lot of flack from their local bar owners who are facing slumping sales and pointing to taprooms as a major culprit. In search of a partner, not a competitor, retailers are becoming more sensitive to the concept of supporting a brewery (through keg purchases) when that same brewery's taproom is stealing their regulars. With those drinkers looking for fresh, new, and local options, moving to an out-of-market draft list isn't likely going to turn things around for the bar and in fact, could make matters worse. Legislative changes in many states have further empowered the brewery's ability to sell direct-to-consumer, which is increasing the friction between the two tiers. With very few breweries experiencing growth in their draft business, some have begun using this friction as an opportunity re-establish a positive relationship with bar owners.

I've seen this done well, and I've seen it fall short. In all cases, the brewery wants to improve their relationship with the retailer. There's no doubt about that. But for me it comes down to what the brewery is giving up. The Law of Conservation of Beer says that sales cannot be created, nor destroyed (I made that up), so the gesture by the brewery will only be meaningful if they're truly make a sacrifice. Let's say the brewery splits a hazy IPA mash into two fermenters, dry-hopping each slightly differently, then sends one to the market with a fancy name marketed as not being poured in the Taproom. Then the other half of the brew stays in the Taproom under a different name. I have no problem with this happening necessarily, I think it's smart. But let's not go throwing yourself a parade for breaking down barriers and putting retailers first. This is a maneuver to make or keep an account excited. But now let's say you have a rare and special beer that's a big draw and could easily sell it all out of your taproom, but instead share it with your retailers. That's how you play the long game and make a real impact. Give something up.

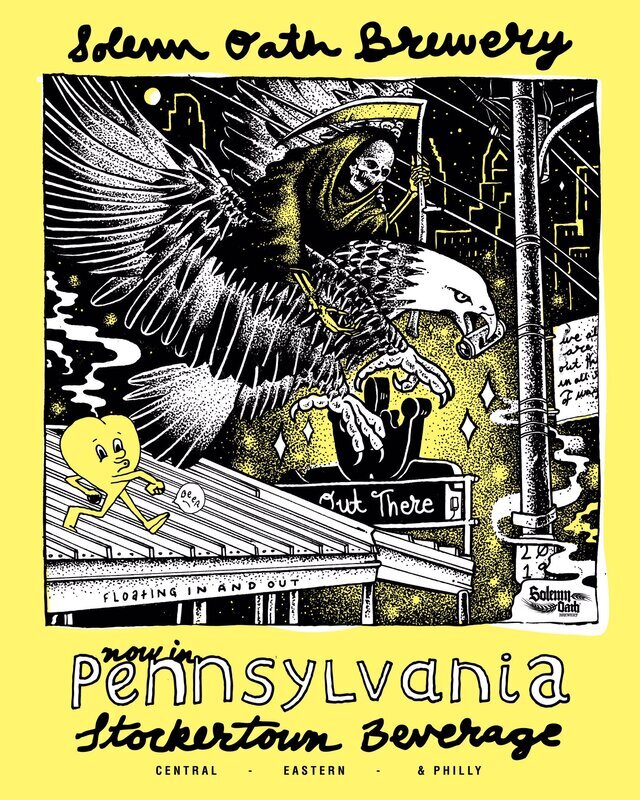

5) Market Expansions Galore

I thought this would be the year that we start hearing a lot more about breweries pulling out of markets, versus launching new ones, but my newsfeeds tell me I was wrong. The big breweries are filling in their last remaining opportunities to go national. Regional breweries are looking to fill in the remaining states where their brand has a chance to resonate. Small breweries continue to launch craft centric markets where opportunities still remain. In a way, it makes sense that this push is still happening. Large distributors will still welcome in a strong behemoth like Founders and Bells with open arms. Small boutique distributorships need exciting brands to build out their portfolio, further their credibility, and add efficiency to their deliveries. The problem is that with growth heading toward flat, something's gotta give.

6) Beer Enthusiasts Lose Their Shit Over Hard Seltzer

If you follow the beverage industry news (Brewbound, Beer Business Daily, Beer Marketers Insights, etc.), you've can't make it through a day without hearing about Hard Seltzer and Cannabis. We've been warned about them regularly for close to two years now, so I can't say I'm surprised to see White Claw and Truly numbers continuing to dominate. But something(s) happened a few weeks ago. I'm not sure if it was Bryan Roth tweeting out a bunch of IRI stats showing how big these FMBs (Flavored Malt Beverages) have gotten compared to the biggest craft breweries. It might have been Chris Quinn and the team at the Beer Temple requesting samples of nearly 100, tasting through them, and talking about it on his popular podcast and social feeds. Or was it Josh Noel coincidentally deciding to taste, review, and rate them that same week, turning the experience into a fascinating story in the Chicago Tribune. In reality, it was all of these things combined, followed by Don't Drink Beer, Worst Beer Blog, and countless other writers and personalities chiming in, making jokes, and having fun with it. Regardless, the online beer enthusiast world seemed to have violently woken up to the fact that these products are where most of the opportunity seems to lie in the alcoholic beverage space. Craft Hard Seltzer is coming/already here. And yes, it's going to be Hazy:

7) 19.2 Cans Executed by Taprooms & Small Breweries

Two weeks ago, I wrote a long piece on 19.2oz cans, and why they're a bad fit for small breweries or those not positioned to sell in convenience channels. By the time I finished writing about "the new tallboys", I had almost convinced myself that it was going to happen anyways, so I wrapped up the post by pontificating whether small breweries would attempt this format in untraditional retail locations. Well it didn't take long for that to come to fruition and while I'm not surprised, I certainly didn't see this coming on January 1.

Three Floyds has taken their stalwart pale ale Zombie Dust and made them available in 4-packs of 19.2oz cans, using the sticker method. Lost Abbey just announced their 11% West Coast Double (triple?) IPA Hop-15 in 19.2oz cans as well, I'd guess going the single-serve method (not four-packs) as they're hitting limited distribution.

8) Hard Tea is a Thing Again

Guest Contributor: Andrew Emerton

Specialty Brand Manager at New Belgium Brewing Co

I’m fully aware everybody’s discussing the golden child, White Claw, and the onslaught of new entrant hard seltzers on the market, but I’m genuinely surprised with the overall resurgence of FMBs – specifically, hard iced teas. I’m not a beer dinosaur yet, but I’ve been in the industry for about 15 years now, which is basically long enough to watch a cycle come and go and come back again. To be honest, I didn’t think FMBs would come back again. At least not with this much force and not with this many open arms, considering we’re in a “health & wellness” cycle. Case-in-point: Twisted Tea. This thing has been around for almost 20 years, it’s got only two flavors, basically zero on-premise presence, pretty dated brand design…and it’s absolutely huge! Twisted Tea is over four times the size of the entire portfolio of Firestone Walker* and almost three times the size of the entire portfolio of Founders* and it continues to grow month after month. How about Arnold Palmer Spiked? This half-tea-half-lemonade spiked thing is basically the size of Sierra Nevada’s Hazy Little Thing. ABI is now line-extending Bud Light with Bud Light Lemon Tea and we’re now starting to see more premium takes on the space with another Boston Beer entrant of Wild Leaf Hard Tea. There’s something going on here and I honestly wasn’t even considering its importance just six months ago, but now am.

*Latest Nielsen 52wk Dollar Sales ending 6/15/19*

Photo Credit: Boston Beer

9) An Early Winter, hopefully not an Ice Age

Guest Contributor: Chris Quinn

Founder of The Beer Temple

I knew that "winter was coming", but I didn't expect for it to be as brutally cold so quickly. So many craft brands have seen a double digit drops in sales in the Chicago market versus a year ago. Even worse, I was shocked that these declines were across the board. I had always thought that some of the low hanging fruit would drop off first, while those making solid beer would be unscathed - at least initially. Instead, I've seen that with very few exceptions, breweries operating within the 3-tier system, (that is non taprooms, brewpubs, and those doing self distribution) have seen a drop in sales - often very significantly. I genuinely hope that this is in fact winter, and not just an unusually cool fall.

10) SAM on SAM action - Boston Beer Company Acquires Dogfish Head

Guest Contributor: Dan Becker

Co-Founder of TheFullPint.com

There is not a single headline or move within craft beer that would shock me, nothing seems sacred, we've all gotten a peak behind the curtain so to speak. From our intel, most of the top 25 craft breweries have entertained meetings with the big boys, famous pioneer breweries that have their best days behind them have formed little "super groups" or have simply sold to private equity, and in some cases, overseas beverage giants. With all of that said, I was expecting to see some of the most notable breweries that appear to be flat in 2018 to show up in 2019 for a good fight, double down on their ideals and see if someone can pull a head in the market that has been chipped away by direct to consumer hyper-localism and hop fatigue. What I did not expect, and stopped me dead in my tracks was Boston Beer Company acquiring/merging with Dogfish Head, a company that has taken on some sizable debt and was looking to make another run at the national beer market. Dogfish Head's founder Sam Calagione has beaten the drum of Independent Craft Beer for so long that they were the last on my list of pioneers to throw in the towel, regardless of their cash position.

11) Wax-Dipped Cans

Guest Contributor: Kate Bernot

Associate Editor @ The Takeout

The past year has seen a profusion in different beer packages, from 8-ounce cans to 250-mL bottles. I'm all for it. But I might draw the line at wax-dipped cans, which Omnipollo has, however ironically, made A Thing. Maybe it's just because I don't trust myself around knives and alcohol, but waxed bottles almost always strike me as more pain than they're worth. Tell me that rich can artwork still looks good after the bits of purple plastic have been scraped off with a butter knife?

12) The Rise of Non Alcoholic Beer

Guest Contributor: Kenny Gould

Founder of Hop Culture Magazine

"Hard seltzer? Sure. Low ABV beer? I get it. But beer without alcohol entirely? When I first read about Heineken 0.0 and other breweries following suit, I thought it was an April Fools joke. Then I thought these breweries must be inflating their numbers, because no one in their right mind would buy beer — an alcoholic beverage — that didn’t have alcohol. But no — it appears that in this instance, at least, I was wrong about a very real and powerful trend. People are buying non-alcoholic offerings, especially health-conscious new drinkers. As someone who has a hard time handling more than 2.5 beverages, I can’t say I’m mad, though I am surprised!"

Image Credit: Heineken

13) Hazy IPA fans embrace Naturdays

Guest Contributor: Worst Beer Blog

A terrible terrible blogger

"It makes sense if you think about it. If your favorite beer is a 25 dollar 4-pack of milkshake IPA, maybe your budget beer would be a 20 dollar 30-pack of Naturdays. It’s made for young people that have no interest in beer, but who could have guessed there were so many people buying craft beer that don’t like the taste of beer. They’re successfully converting craft drinkers to big beer and being completely honest about it. No acquisitions were made. This isn’t a Bud Light Mang-O-Lime-a-Rita with a Golden Road label slapped on it. This is malt liquor with artificial strawberry lemonade dumped in it and people are loving it. The craft drinker doesn’t want a premium AB InBev product. They aren’t looking for discount BBA stouts. McDonalds could make a decent steak for 6 bucks if they wanted to but nobody would buy it. They want processed chicken McNuggets with yummy sauces."

Thanks for reading. Let us know what you think and what we might have missed on Twitter, Instagram, or using the comments below. Thanks to Andrew, Chris, Danny, Kate, Kenny, and WBB for their contributions. They all do great work in their own unique way.

If you're connected in any way to the to industry and are interested in participating in a future collaborative post like this one, hit me up at doug@beercrunchers.com.